There is a Yiddish proverb: “Better an ounce of luck than a pound of gold.”

Well, the American advertising sector may expect both in the years to come as the sports betting sector is expected to grow at speed. With fascination and fandom at an all-time high across properties such as the National Football League, the National Basketball Association and the National Hockey League, this has been a largely untapped market that is just beginning to wake up.

Sports betting, wherever legal, has been big business that has come with many issues along the way. Countries such as Germany, Britain, Finland and Australia have their own ways of regulating and monitoring the gambling advertising sector, which has proven to be continually innovative and increasingly lucrative.

We see explosive growth on the horizon for the sports betting category in the U.S.

Phil Gaughran, global head of brand and communications for Dentsu

As America opens itself up to enable more sports betting across its states—the U.S. Supreme Court removed the federal ban on single-game wagering in 2018—it will inevitably meet some of the same issues other countries have faced. But that does not deter the expectation of continued growth to drive more people to test their luck or knowledge.

Gambling in the U.S., in some capacity, has grown to 48 states over the last three years with sports betting now legal in 26 states, including the most mature region of Nevada being joined by New York, Washington and New Jersey. California is also expected to vote in 2022 on the legalization of sports betting in the state, growing the market even further.

And then there is the Canadian marketplace which only legalized single-event sports betting in August.

“We see explosive growth on the horizon for the sports betting category in the U.S.” said Phil Gaughran, global head of brand and communications for Dentsu. “Different from Europe where sports betting shops can be found in every village, town and street corner, the U.S. has kept betting to specific locations such as casinos and sportsbooks. Now that the laws are changing, and rapidly, state by state, there is huge money to be made, and marketing dollars will follow. We see the U.S. potentially leapfrogging other countries as accessibility for betting comes into the home, not just simply around the corner from the bar.”

Gaughran compared that growth to that of cannabis being legalized state by state, making the use of data targeting “an essential part” of the marketing and offering tailored experiences to audiences.

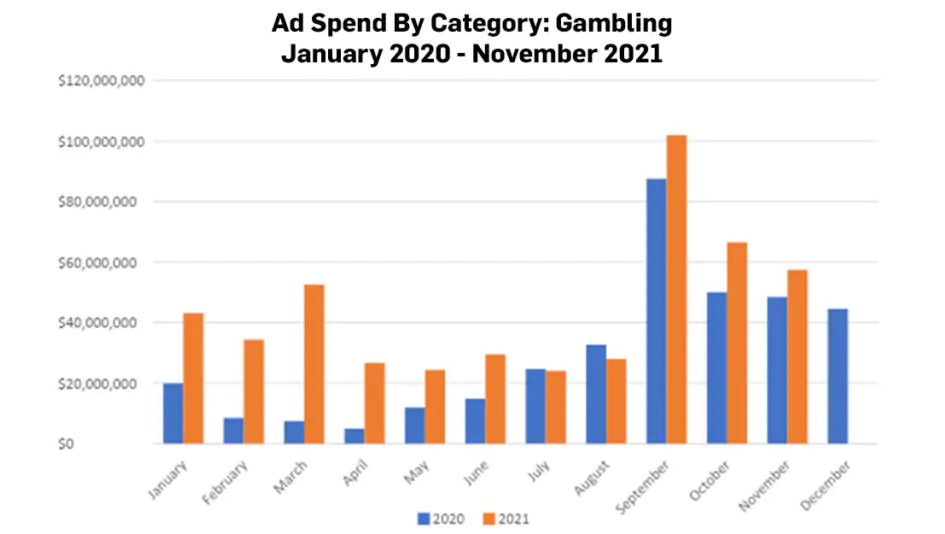

The predicted growth in advertising spend

According to research from MediaRadar, between the months of November 2020 and November 2021, $488 million was invested by the gambling sector with TV making up over two-thirds (69%) of that spend, almost reaching $336 million, an increase in investment of 63% year-over-year.

Gamblng adspend in the US is expected to continue to grow in 2022

Digital spend, the second largest in the sector, grew 52% during the same period to record nearly $140 million, taking 29% of media spend overall.

The majority of budgets came from fantasy sports companies such as DraftKings and FanDuel, with traditional bet makers such as Bet365, Landry’s, Caesars Entertainment and MGM Resorts International joined by online companies such as Flutter Entertainment and Sugarhouse HSP Gaming in the top 10 companies by spend.

“The regulatory environment has become increasingly friendly to betting platforms. As a result, we’re seeing increased ad investment to attract gamblers. Additionally, as platforms begin to accept digital currency and use VR to enhance the gaming experience, there are substantial opportunities to attract new audiences. While we think brick-and-mortar casinos will continue to struggle at the beginning of the year, we expect the overall gambling industry to continue to grow in 2022 and beyond. This will likely lead to the continued increase in advertising investments across the industry,” predicts MediaRadar CEO and co-founder Todd Krizelman.

According to research conducted by advertising measurement firm EDO, in 2018 just $32 million was spent on running 5,600 TV adverts promoting gambling that year, in contrast with 2021 up until December which recorded a fivefold increase in three years of 31,000 ads running at a cost of $198 million. A growth of almost half (48%) in 2020 found, unsurprisingly, DraftKings and FanDuel to be the top spenders. Both are estimated to have bought media valued at over $56 million each.

As platforms begin to accept digital currency and use VR to enhance the gaming experience, there are substantial opportunities to attract new audiences.

Todd Krizelman, CEO of MediaRadar

“We anticipate this trend will begin to level out in 2022 as gambling advertisers figure out how to avoid regulatory attention while continuing heavy investment to reach the right audiences with the right messages in the right contextual programming,” Kevin Krim, CEO, EDO added.

Great content! Keep up the good work!

First time here, haha